The variable contribution margin for a pepperoni pizza is $9.50 ($15 – $5.50). To make and package each pizza, it costs the shop owner $5.50. The variable contribution margin is the solution to this calculation (price – variable costs).įor example, a pizza shop’s most popular item is the pepperoni pizza. Step 3: Subtract the variable costs from the price. Variable costs change with your sales, including direct materials, direct labor, and shipping expenses. Step 2: Determine the variable costs for the product or service. Step 1: Find the price of the product or service, or the amount the item sells for at your business. You can find the variable contribution margin with these three steps: The variable contribution margin is the difference between revenue and variable costs. Because the variable costs increase faster than revenue, you lose money. The variable costs are $6,000, while revenue is $5,500. This month, variable costs double, but the revenue only increases by 10%. If your variable costs rise faster than your revenue, you won’t make a profit.įor example, last month, your variable costs were $3,000 and your revenue was $5,000.

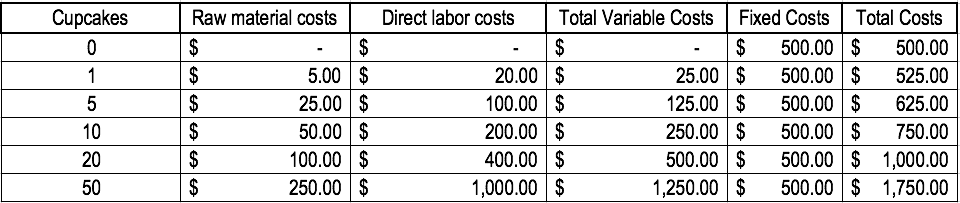

But, your revenue should increase faster than your expenses. But, the rise in sales also brings more revenue into your business.Īs revenue increases, so do the variable costs. The amount you spend on variable costs increases. When sales rise, you need to make more products or prepare to perform more services. Rising variable costs are not always bad news for your business. If your business’s sales decrease, your variable costs will decrease. If your business’s sales increase, the variable costs will increase. Your total variable costs are $8,000 (800 X $10). The cost per unit, or the cost to you for each T-shirt, is $10. Let’s say you own a business that sells T-shirts. Total variable costs = total number of a product or service sold X variable cost per unit Use this formula to find the total variable costs: To find your total variable expenses, multiply the total products or services you sell by the variable cost per unit. Shipping and packaging: The more goods you ship, the more you pay for shipping and packaging.Īs a small business owner, you should know your total variable costs.

Commissions: The more your commissioned employees sell, the more you pay out in commissions.Direct labor: The more business you do, the more hours your employees work.

0 kommentar(er)

0 kommentar(er)